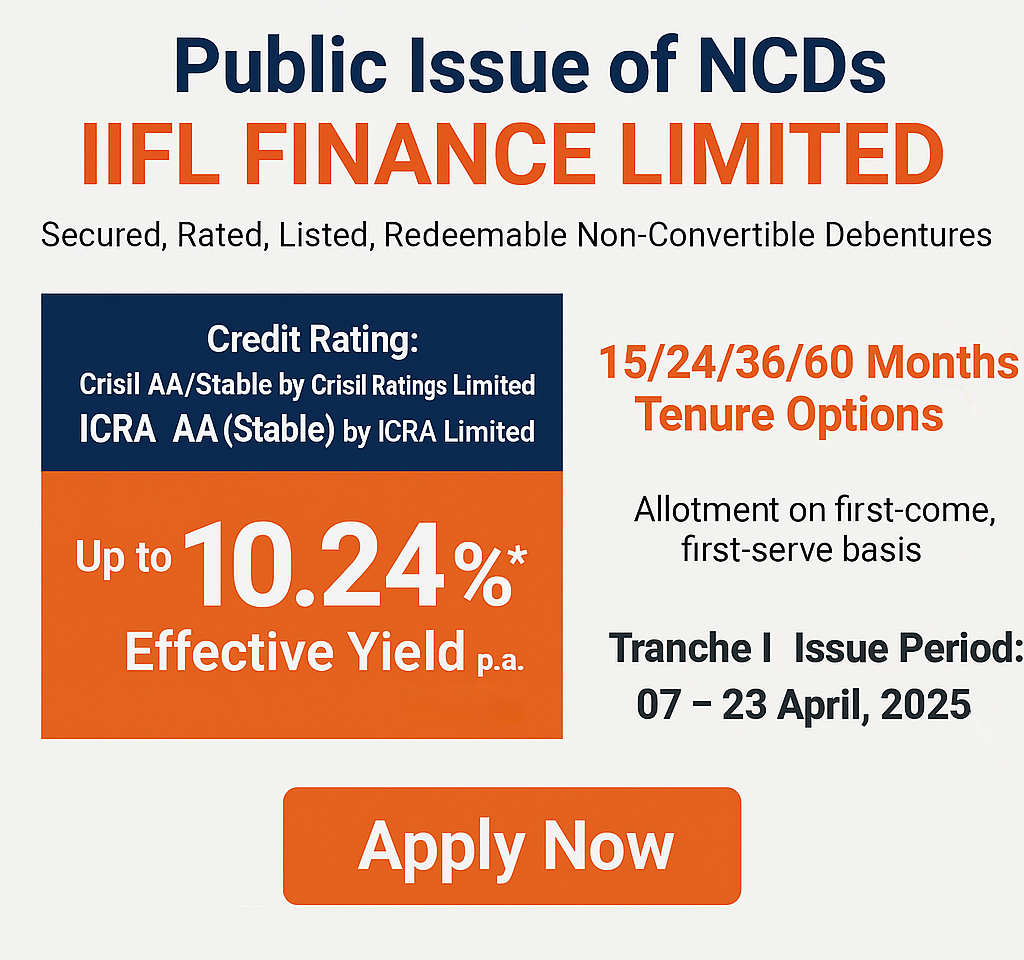

IIFL Finance Limited has launched a fresh tranche of secured, redeemable Non-Convertible Debentures (NCDs) in April 2025. This issue offers an attractive opportunity for investors seeking fixed-income returns with relatively low risk. In this article, we’ll break down everything you need to know: features, interest rates, safety, and how to apply.

🔹 About IIFL Finance

IIFL Finance is a well-established Non-Banking Financial Company (NBFC) offering a variety of financial services including home loans, gold loans, business loans, microfinance, and loans against securities. The company has a wide reach across India and caters to both individuals and businesses.

💰 IIFL NCD April 2025 – Key Details

- Issue Opens: April 7, 2025

- Issue Closes: April 23, 2025

- Type of Instrument: Secured, Listed, Redeemable NCDs

- Face Value: ₹1,000 per NCD

- Minimum Investment: ₹10,000 (10 NCDs)

- Issue Size: ₹100 crore (base) + ₹400 crore (green shoe option), total ₹500 crore

- Tenure Options: 15, 24, 36, and 60 months

- Listing: BSE and NSE

- Allotment Basis: First come, first served

- Registrar: KFin Technologies Ltd

- Debenture Trustee: Vardhman Trusteeship Pvt Ltd

📈 Interest Rates and Options

The NCDs offer multiple tenure and payout options:

| Series | Tenure | Frequency | Interest Rate | Yield (%) |

|---|---|---|---|---|

| I | 15 months | Annual | 9.00% | 9.06% |

| II | 15 months | Cumulative | – | 9.00% |

| III | 24 months | Annual | 9.30% | 9.30% |

| IV | 24 months | Cumulative | – | 9.30% |

| V | 36 months | Monthly | 9.35% | 9.76% |

| VI | 36 months | Annual | 9.75% | 9.74% |

| VII | 36 months | Cumulative | – | 9.75% |

| VIII | 60 months | Monthly | 9.60% | 10.03% |

| IX | 60 months | Annual | 10.25% | 10.24% |

📊 Credit Ratings

The NCDs are rated as follows:

- CRISIL AA/Stable by CRISIL Ratings

- ICRA AA (Stable) by ICRA

These ratings indicate high safety and low credit risk for investors.

🎯 Objectives of the Issue

IIFL Finance will use the proceeds from this issue for:

- Onward lending and financing activities

- Repayment of existing borrowings

- General corporate purposes

✅ Why Should You Consider Investing?

- 🔒 Secured Investment – Backed by company assets

- 📈 High Returns – Up to 10.25% interest

- 📅 Flexible Tenure Options – Choose from monthly, annual, or cumulative payouts

- 🛡️ Strong Credit Rating – CRISIL and ICRA rated AA/Stable

⚠️ Things to Keep in Mind

- Interest is taxable as per your income slab

- Liquidity may be limited in secondary markets despite listing

- NBFC sector risks apply due to changing interest rates or credit market conditions

📞 Contact Us to Apply

📝 Interested in applying for this NCD?

Fill out the form below and our team at Ridhi FinServ will get in touch to guide you through the process.

🔒 Your information is safe with us. We don’t spam.

For any queries, you can also reach out to us directly via WhatsApp or call us at +91 6282 076 221

📄 Prospectus Link

You can view the detailed prospectus on the BSE website here:

🔗 IIFL Finance NCD April 2025 Prospectus (BSE)

Leave a reply to allamannautica Cancel reply